AI Bubble = Not!

The Next Equilibrium = Re-valuation

AI Bubble = Unlikely, yet the Next Equilibrium will True Up Future Valuations after exuberance!

I see headlines frustrating to me everywhere asking: “Is AI a bubble?” or even some others stating, “The AI Bubble!” as if it exists to warn about. This most often leads to a commentary making references to the dot.com bubble burst, which began in March in the year 2000. Today’s AI Bubble phrases dominate financial media, echoing fears of dot.com style collapse playing out as a "bubble burst". But my view based on my depth of experience is different: the AI story is not about fragility or impending burst, should there be a reaction to disillusionment it should trigger a recalibration - not a burst.

Unlike the dot.com era, where investment dollars flowed primarily into unproven new ventures with no profits and only future hopes, today’s AI-enhanced valuations are being applied heavily to established megacap businesses with solid profitability. AI is being integrated into existing business models, improving efficiency and opening new revenue streams, not funding speculative ideas that may or may not survive. Therefore, if investor expectations run ahead of the actual pace of change, any later downward adjustments would be a managed reevaluation and not a burst. Sure, some investments are made in small startup enthusiasts that may or may not succeed, and there could be a small bubble burst at this level, but as to the overall market there should not be a significant impact; explanations below…

1. The Bubble Illusion

The term “bubble” implies fragility — that once pricked, the entire system collapses. The dot.com era is remembered this way: countless firms with no revenue soared on page views and promises, only to evaporate when capital dried up. Amazon and Google survived, but most players vanished. Our **AI story today is not the same.**

Today’s megacaps are not speculative startups — they are profitable, cash-rich enterprises pouring billions into AI infrastructure. When Microsoft books real revenue from Copilot, or Oracle monetizes AI-driven cloud workloads, we are not looking at vapour. We are looking at incremental productivity and optimization and newly enhanced intelligence for business decision making, real customer adoption, and sticky integration. If certain smaller firms fail, that’s not a bubble bursting — it’s simply a contained risk.

A Personal Flashback to 2000

In the year 2000, while working as a Chief Enterprise Architect for a $54 billion global organization, I took a call from a friend managing a $20 billion fund. The call lasted only a few seconds — all I heard was: *“Cash is King!”* and he hung up. I had to think who's voice that was, and when it became clear to me I then immediately trusted the urgency, and called my stock broker to sell everything at market value. One example: I sold my Oracle (ORCL) shares at $32.50, despite my broker urging me to hold because it had just been at ~$34. Over the next year or two, Oracle plunged to nearly $6.25 a share as the dot.com era came to an end. Look at this solid tech company today, over $230.

This personal flashback illustrates the true fragility of the dot.com bubble days — when high valuations rested on companies without profits or durable models, there was a market-wide burst. By contrast, today’s AI valuations are mostly anchored in profitable megacap businesses. If a pullback comes, it will likely be a managed revaluation tied to adoption pace and efficiency, not a system-wide collapse. This bridges back to the Bubble Illusion: the AI cycle today represents a move to get to a New or "Next Equilibrium" (for those aware of Michael Porter), not a bubble burst because there should not be a bubble to burst (as noted, likely a small one will happen but it could not be a market mover).

2. Leadership Resistance vs. Worker-Led Adoption

Another factor behind the illusion of fragility is human resistance to change, "failure to embrace". Studies show a striking disconnect: employees are adopting AI faster than many leaders realize. A McKinsey survey revealed that while only 4% of executives believed employees used AI for 30% of their tasks, 13% of employees reported doing so. This underestimation slows strategic adoption. Harvard Business Review also notes demographic gaps — younger employees embrace AI readily, while uptake is lower among older workers. This plays out in the media, impatience about the AI disruption results in very short lived swings of optimism and disillusionment happening only months apart (shorter rapid cycles of attention causing confusion over progress). I think my "AI and Your People" blog from 2019 [click here if interested] still holds up well.

3. Reaction vs. Rebound

The media tends to emphasize the reaction — layoffs, displaced roles, consultants replaced, or job cuts at firms like McKinsey. But the rebound story is underreported or not yet happened but is coming. Every industrial revolution caused dislocation, yet unemployment today is historically low. Why? Because new categories of work always emerge. AI will create demand for roles in AI governance, training, oversight, orchestration, and human-AI collaboration. These rebound jobs may not grab headlines, but they are critical to long-term success.

4. Selective Bubbles, Systemic Strength

There will be small bubbles among unprofitable startups chasing hype, just as there were during the dot-com boom. The difference is scale. In 2000, speculative firms dominated market flows. Today, they are the exception. The majority of investment capital is directed toward profitable megacap incumbents. If smaller firms fail, they will not take down the system. The megacaps remain diversified, cash-rich, and strategically positioned.

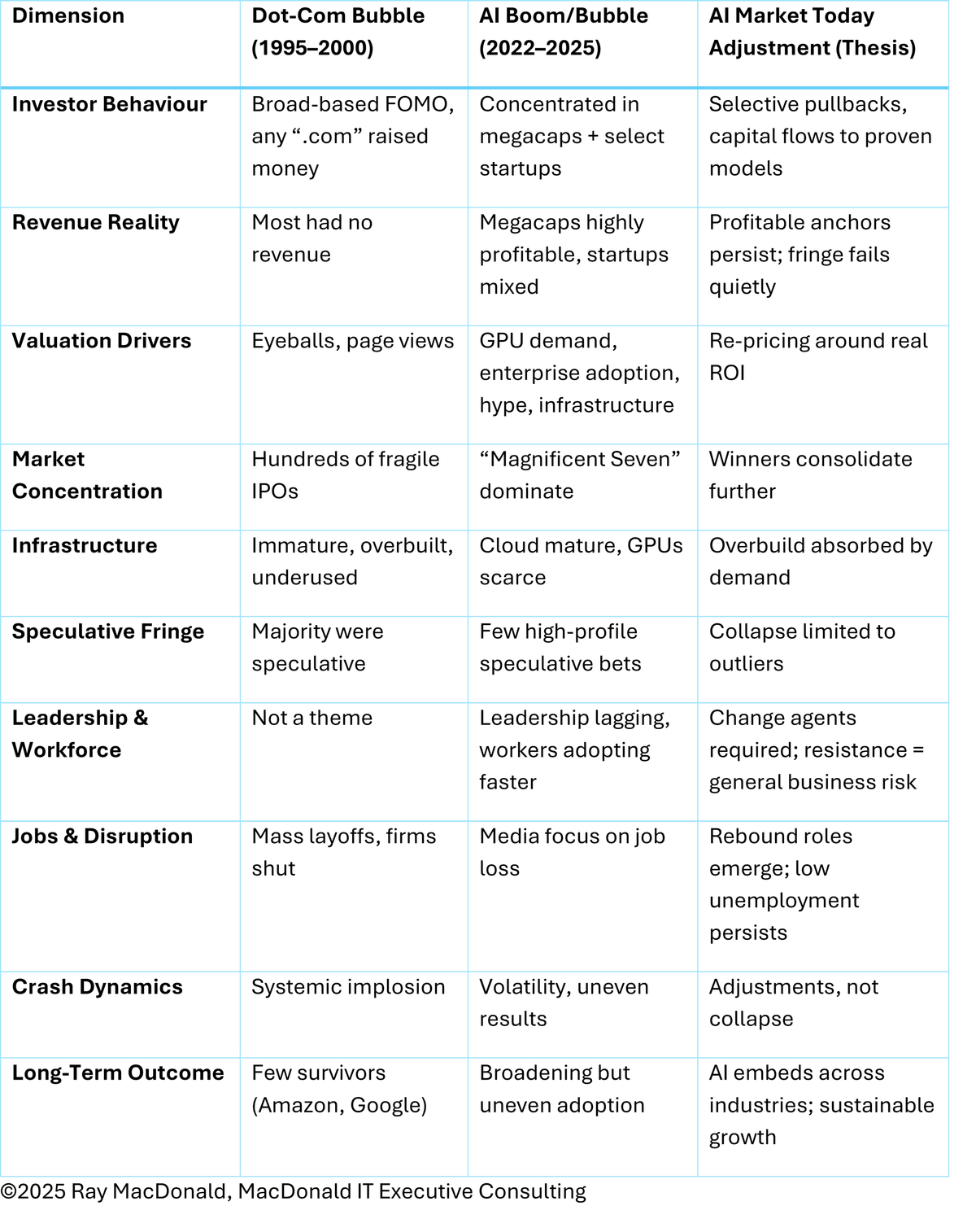

5. Comparison Table, dot.com vs AI market today

Conclusion

So, has AI created a market valuation bubble? Not likely. Certainly, there will be speculative edges, but the sector is not fragile. It is disruptive, messy, and uneven — but fundamentally grounded in solid business investments. What we are witnessing is not likely a repeat of the dot.com collapse, but a period of digestion that will have multiple recalibrations. Winners will be those leaders who act as change agents, reimagining workflows and strategy with AI at the centre. There is no existing large “AI bubble” waiting to burst. It is already deflating where it must, while building durable foundations primarily within solid enterprises.

Written by Ray S, MacDonald — Executive Advisor, Leadership Coach, and Watchman at the Gate of Change.

#TruthAtTheGate #Leadership #AIGetsPersonal #DigitalRisk

See me at www.raymacdonald.com or www.macdonaldexec.com